A Unified Accounting API offers transformative benefits for various financial processes. They facilitate access to data and enable automations for SaaS tools that help their clients be more efficient, accurate, and make better decisions.

Here are detailed use cases demonstrating how Chift’s Unified Accounting API can be leveraged. But first, let’s quickly explain what a Unified Accounting API is.

What is a Unified Accounting API?

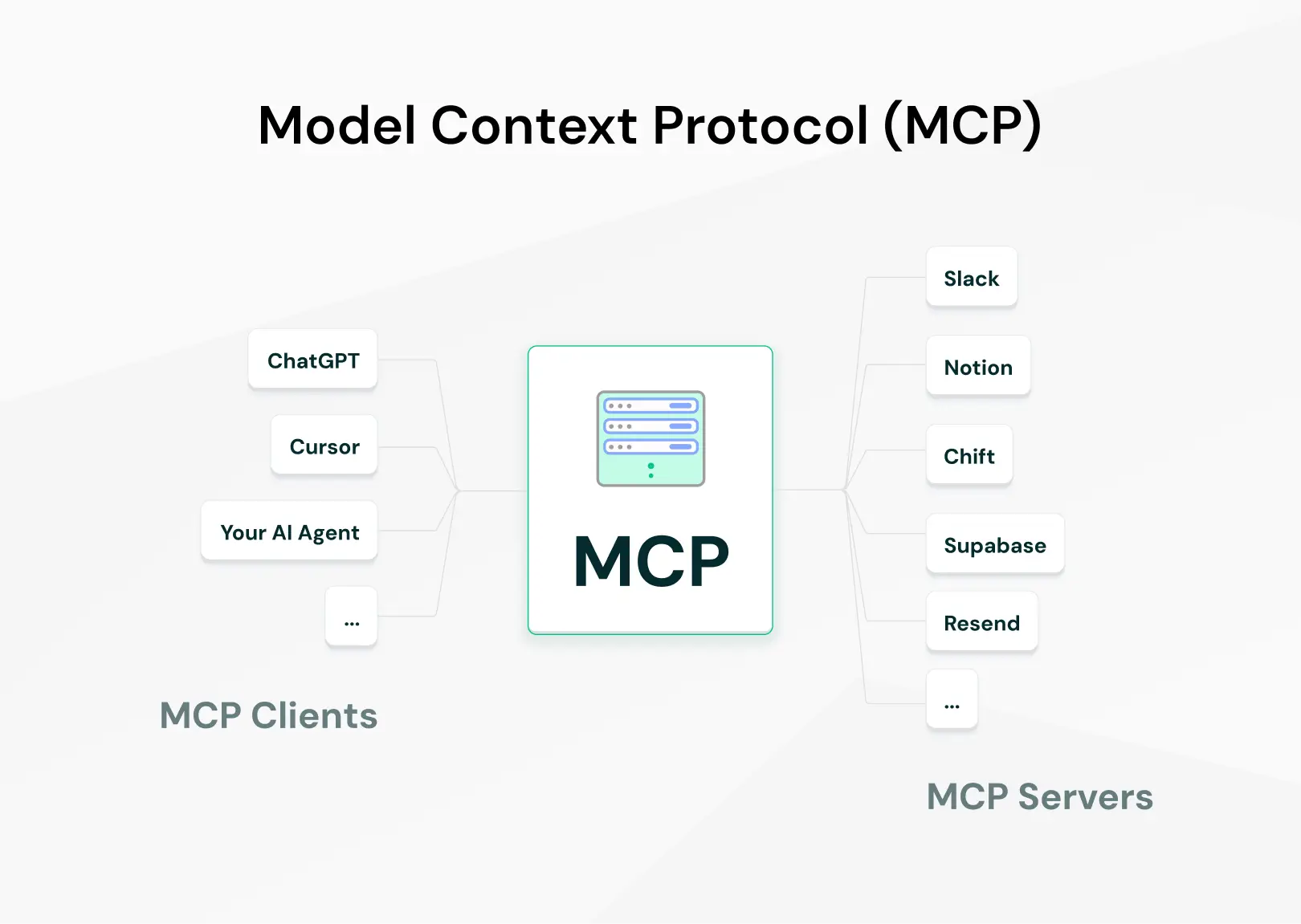

A Unified API is an interface that consolidates multiple APIs into a single and consistent access point, simplifying integration with various software. In practice, it is a layer of abstraction where the routes of different APIs are brought together and standardized. Or, even more concretely, you can think of it as a power strip for software.

Our Unified Accounting API focuses on connecting your software to all the major European accounting software so you can integrate with all the accounting tools used by your users in one integration. It includes Sage, ACD, Pennylane, MyUnisoft, Cegid, and many other accounting software.

We also offer a Unified Invoicing API, Unified Ecommerce API and Unified POS API.

Read our Unified Accounting API article to dive deeper into the topic.

Unified Accounting APIs use cases

Here are some interesting use cases leveraging the power of a Unified Accounting API:

Cash Flow Management

By pulling accounts receivable (client invoices) and accounts payable (supplier invoices) from different accounting systems used by their clients, cash flow management platforms can offer real-time cash flow reporting and projection/forecast features to their users.

Debt Recovery

A Unified Accounting API can significantly streamline the debt recovery process. By extracting client invoices from accounting software, debt recovery software vendors can automate client payment reminders, reducing the manual effort involved in following up on overdue payments. Additionally, updates on payment statuses can be sent back to the accounting software automatically, ensuring that the records are always up-to-date. This automation not only improves the efficiency of the debt recovery process but also helps maintain accurate financial records, which is crucial for financial reporting and auditing purposes.

Lending

Lending platforms can benefit greatly from a Unified Accounting API by connecting to a user’s accounting software to offer instant loan eligibility status. Real-time access to up-to-date accounting records allows lenders to assess the financial health of applicants quickly and accurately. This access can streamline the loan approval process, reducing the time needed for manual entry and enhancing the overall user experience. They can also offer personalized loan products tailored to the financial situations of their clients.

Invoice Automation

With a Unified Accounting API, you can automate the data transfer between invoicing or ERP software and the accounting software. This automation saves hours of manual exports and imports, reducing the potential for human error and freeing up valuable time for finance teams to focus on more strategic tasks. Additionally, new supplier or client accounts can be automatically created in the accounting tool, ensuring that all financial transactions are recorded accurately and timely.

Expense Management

Seamlessly and automatically sync expenses with accounting software, ensuring that all expenses are accurately recorded and categorized. Streamline the expense management process, making it easier for businesses to monitor and control their spending. Automated expense tracking reduces the administrative burden on employees, who no longer need to manually input expense data.

Ecommerce Sales Synchronisation

Ecommerce merchants need their accounting books to reflect their online sales. Chift’s Accounting API allows the export of aggregated sales and VAT data to accounting tools without manual exports. This includes for examples: value, payment method, product categories and much more.

Point Of Sale (POS) Z Report Reconciliation

Restaurants and shops handle large amounts of cash and card payment throughout a single day. For that reason, at the end of the day their POS systems output a list of of all the transactions of that day, which is called a Z Report. Not only does the Z Report let business know if the cash in the register is over or under what the POS has recorded, but it also allows sales to be reconciled with accounting. Accounting and POS software can automatically send the daily Z Report to the accounting thanks to Chift’s Unified POS and Accounting API. It supports a wide range of data such as payment methods, VAT rates, tips and more.

Payment Fees Reconciliation

Businesses use payment providers to facilitate payments for their clients. As providers charge a fee on each payment, the value of an order differs from the amount the business receives. In addition to that, payment providers typically send a monthly fee report. By integrating with our Unified Accounting API, payment providers help their users automatically send payment fee data to accounting, enabling payment fees reconciliation.

There are many other use cases for a Unified Accounting API. Find out below why the best SaaS vendors choose Chift’s Unified APIs.

Gain a competitive edge with Chift’s Unified Accounting API

Chift’s Unified Accounting API helps you unleash the power of integrations:

- Low Cost and High Scalability: A single integration enables connections and standardized data from the most popular European accounting tools. No more heavy & costly maintenance work is required.

- European Focus and Expertise: With its European focus, Chift makes it easy to integrate with the most popular accounting tools in European countries.

- Increase Your TAM and Close More Deals: Prospects will only consider software that integrates with the current tools they use. Each new accounting software you integrate with opens up a new customer segment or a new market.

- Increase Product Velocity: Fast external integrations and developers focused on your core product lead to faster product iteration and feature throughput. This allows you to keep up with clients’ expectations.

- Amazing End-User Experience: Fast and customizable integration activation and advanced onboarding features mean that integrations remain frictionless.

- Built for Developers: Unified Doc, Dev Platform, automated testing, and Integrations Dashboard make it easy for your developers to set up, test, launch, and manage integrations.

- Empower Your Marketing Team: An accounting integrations portfolio is a key selling point. Integrations also open up co-marketing opportunities with accounting software vendors or strategic partnerships with accountants.

- Chift Syncs - No-code Integrations: For those who don’t feel like coding at all, we have developed Chift Syncs. With Syncs, we integrate your API with our Unified APIs to offer you no-code, ready-made flows. You decide how your users activate integrations, embedded or marketplace, for a true white-glove experience.

Fintech leaders use Chift’s Unified APIs

Our Unified Accounting API is used by the best B2B SaaS Vendors. You can learn more about its uses by visiting Chift’s Case Studies Page.

.avif)

Gain a competitive edge and position yourself for success in an increasingly data-driven world by working with Chift. Reduce costs and development time associated with integrations, close more deals, and increase product velocity.

Curious about how you can use Chift’s Unified Accounting API for your integrations? Reach out to our team for a demo.

.avif)