In the ever-evolving landscape of financial technology, integrations have become integral to convincing prospects to use your software. However, high costs and clashing roadmaps have made it difficult for software editors to keep up with the demand for integrations. This is particularly true for accounting integrations, with many Product Managers and CXOs looking for a reliable and scalable way to offer accounting automations.

A unified Accounting API will not only add integrations with major accounting tools like Sage, Pennylane, Cegid, and more, but it will also empower business management software with automated bi-directional flows.

This article delves into the concept, benefits, and implications of unified APIs in accounting, offering a comprehensive understanding of their pivotal role in modern finance.

In-house accounting integrations: high cost & low scalability

Your integrations strategy can significantly impact your company's resources, time to release, and priorities. The first integration strategy that comes to mind is usually in-house integrations.

Building integrations involves allocating some of your developers to implement and maintain integrations. Only after the first integration is done does the vendor often realize the significant work involved and the huge hidden costs due to maintenance. Counting exploration, building, and especially maintenance (the most underestimated cost), a single integration can cost up to €50,000 per year. Moreover, the opportunity cost is also significant: each day spent on developing integrations is not spent on advancing the product and progressing on the roadmap.

Want more information about integrations strategies? Check out our in depth article Build or Buy Integrations? Partner Instead!

Unified Accounting API use cases

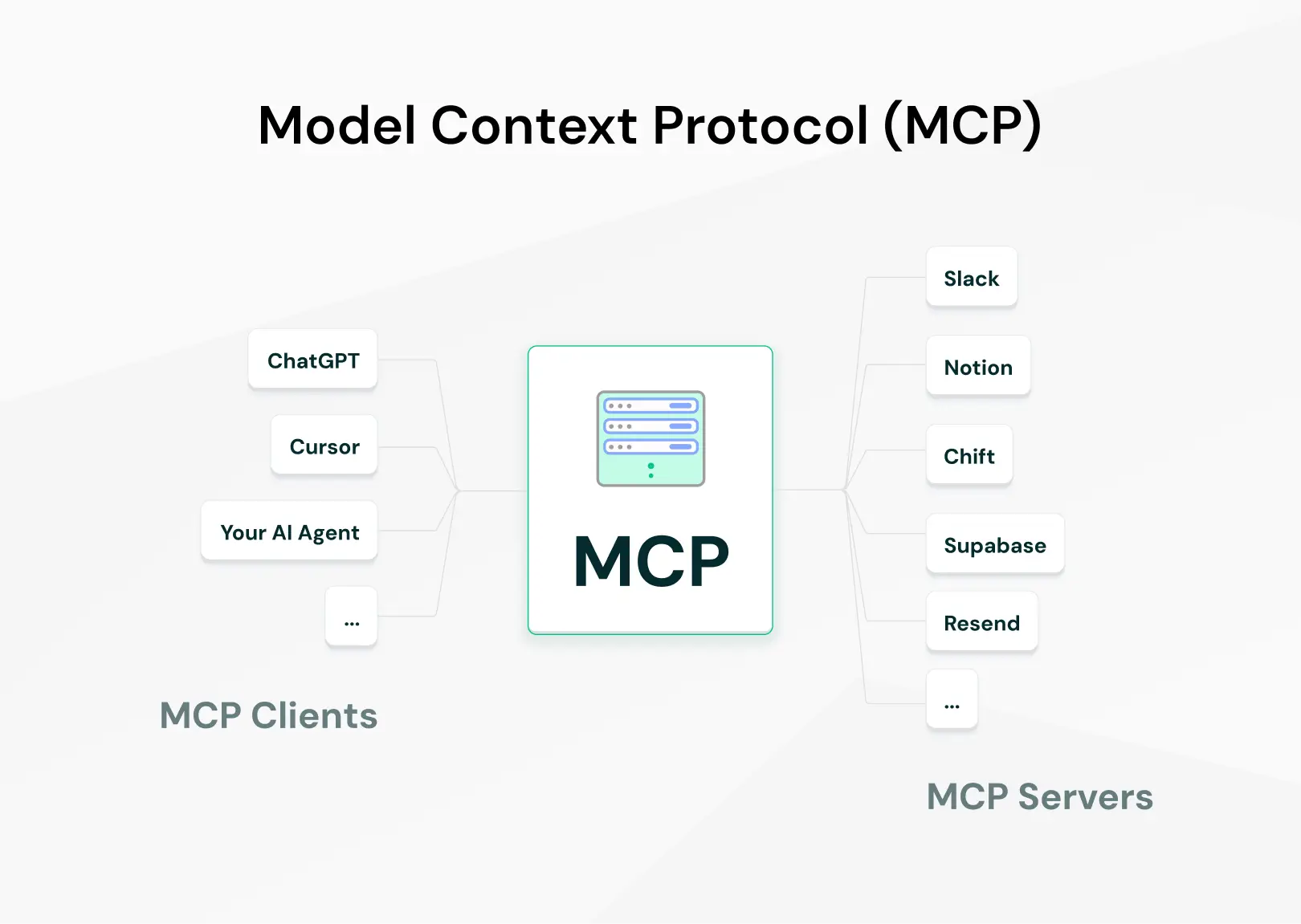

The most efficient way to add integrations is by using a Unified API provider. Its standardized interface allows you to integrate with multiple software or applications through a single integration rather than dealing with the complexities and variabilities of different APIs.

Unified APIs are particularly valuable for accounting data, as financial data is needed across business software categories, and data silos can hinder operational efficiency and decision-making. By providing a singular interface to multiple accounting systems, unified APIs act as an embedded finance enabler and reduce the time and effort required for data management. Here are a few use cases:

- Cash Flow Management: By integrating accounts receivable (client invoices) and accounts payable (supplier invoices) from different accounting systems, users gain a holistic view of their financial status through cash flow reporting and forecasting.

- Debt Recovery: Extract client invoices from accounting software to offer automated client payment reminders. Send updates back to accounting to update payments status.

- Lending: Connect to a user's accounting software to offer instant loan eligibility status using real-time access to accounting records.

- Invoice Automation: Invoicing and ERP platforms can send data automatically to a user's accounting software, saving hours of manual export and import. Automatically create new supplier or client accounts in the accounting tool.

- Expense Management: Unified Accounting APIs facilitate seamless integration of expense tracking tools with accounting software. This ensures that all expenses are accurately recorded and categorized, streamlining the expense management process and improving budget adherence.

This is only a handful of the applications of a unified Accounting API. For a full breakdown of use cases and links to our case studies, see our article The Best Use Cases of a Unified Accounting API.

Chift’s Unified Accounting API - Your new ROI ally

Chift’s Unified Accounting API offers a simple and efficient solution to a complex problem.

.webp)

Low cost / High scalability

Thanks to Chift’s Unified Accounting API, a single connection enables integrations and standardized data from the most popular European accounting tools. No maintenance required. Quickly scale your integrations while cutting your integration costs and preserving your product’s roadmap.

We add new integrations to our Accounting API regularly so check our website for an updated list of accounting integrations.

European focus and expertise

European companies use a wide range of accounting software. Many of those tools are specific to a single country, and some of the largest are on-premise software such as ACD, Cegid, or Sage. This can make it very difficult for software vendors to scale their accounting integrations.

With its European focus, Chift makes it easy to integrate with the most popular accounting tools in European countries.

Related: What Are Local Agents and How Can They Help You?

Increase your TAM and close more deals

In addition to the European accounting software market being fragmented, we know that prospects will not consider a software that does not integrate with the curent tools they use. This means that each new accounting software you integrate with opens up a new customer segment or a new market. As such, adding integrations allow you to close more deals and expand your Total Addressable Market (TAM).

Increase product velocity and reduce churn

With scalable external integrations and your developers focused on your core product, your product iteration and feature throughput can reach new speeds.

This allows you to keep up with clients’ expectations and reduce churn.

Give your users the best experience

Integrations can be easily activated in a few clicks through your product integration marketplace (embedded), through unique links to data flow setups or through Chift’s customizable white-labelled marketplaces. With marketplaces, you only need to share one link with your customers without having to deal with connecting to Chift. You decide how your users access and activate integrations.

As setting up accounting integration mappings can involve advanced accounting knowledge or accounting software credentials that your user might not have we offer advanced onboarding features. With Chift, your users can easily invite a third-party, such as their accountant, to complete the mapping or enter credentials.

Make life easier for your developers

Creating software is hard enough, so we built unique features to offer your developers the best integration experience:

- Unified Doc: Stop wasting time on accessing and understanding API documentation with Chift’s unified doc.

- Dev Platform: Create integrations and test them easily with test payloads.

- Integrations Dashboard: Easily monitor integrations in real-time and track usage per client, connector activation, API calls, and transactions.

- Security: Chift supports easy auth flows and data encryption.

Empower your marketing team

Accounting integrations have become some of the most sought-after product features in multiple product categories, such as cash flow management, debt recovery, or CRM platforms. Use your accounting integration portfolio as a key selling point and gain a strong integration-first reputation.

Integrations also open up co-marketing opportunities such as webinars with accounting software vendors or strategic partnerships with accountants.

Chift Syncs - No-code integrations & white glove experience

You can integrate with our Accounting API and directly access integrations to over a dozen accounting software.

But for those who don’t feel like coding at all, we have developed Chift Syncs. With Syncs, we integrate your API to our Unified APIs to offer you no-code ready-made flows. Your decide how your users activate integrations, embedded or marketplace for a true white glove experience.

Fintech leaders partner with Chift

Gain a competitive edge and position yourself for success in an increasingly data-driven world by working with Chift. Reduce costs and development time associated with integrations, close more deals, and increase product velocity.

Curious about how you can use Chift’s Unified Accounting API for your integrations? Reach out to our team for a demo.

.avif)